Tuesday, December 9, 2008

A Difficult Selling Environment

If you are trying to capture as much value as possible during the sale of your home, you have probably at least thought of trying to sell your house without the assistance of a realtor (For Sale by Owner) to avoid the 5-6% realtor's fee. The Longmeadow- For Sale by Owner service provided by LongmeadowBiz.com can provide an important component of your marketing plan. This service will certainly provide a cost effective method for getting the needed visibility for potential buyers.

In today's market, most home buyers (both local and long distance) are doing their own searches to find their new home through the Internet and their most likely starting point is Google search.

Because of the large number of home owners that have used the Longmeadow FSBO service and the high number of website visitors, Google search results for important key words related to the Longmeadow real estate market are very high…

Below are some examples… simply click on the link to view the Google results.

Longmeadow FSBO

http://www.google.com/search?hl=en&q=longmeadow+fsbo

# 1 out of 13,300 results

Longmeadow house for sale by owner

http://www.google.com/search?hl=en&q=longmeadow+house+for+sale+by+owner

# 1 out of 10,300 results

Longmeadow home for sale by owner

http://www.google.com/search?hl=en&q=longmeadow+home+for+sale+by+owner

#1 out of 73,900 results

Longmeadow for sale by owner

http://www.google.com/search?hl=en&q=longmeadow+for+sale+by+owner

#1 out of 23,400 results

The direct link to Longmeadow FSBO is: http://www.longmeadowbiz.com/realestate/index.htm

For humor to make things a little less stressful in this difficult time, view the following video....

If you are looking to sell your Longmeadow house via FSBO, please consider using our Longmeadow- FSBO service as part of your marketing plan. You will be glad that you did!

Jim Moran

LongmeadowBiz, LLC

www.LongmeadowBiz.com

Sunday, December 7, 2008

Latest Longmeadow Home Sales Results

A bright spot in the latest data is that home sales results for the latest five months (July through November 2008) were equivalent to the same period in 2007 and only slightly lower than that for 2006 (85 transactions vs. 85 and 89).

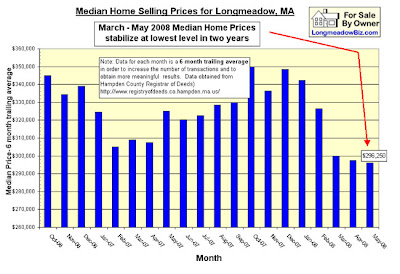

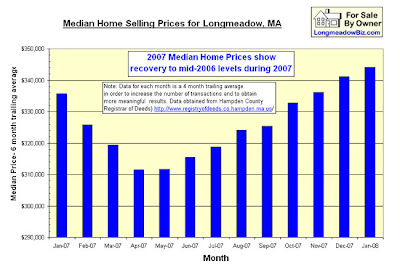

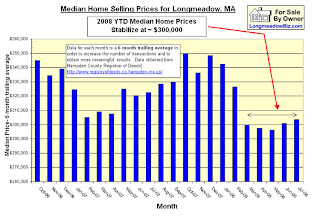

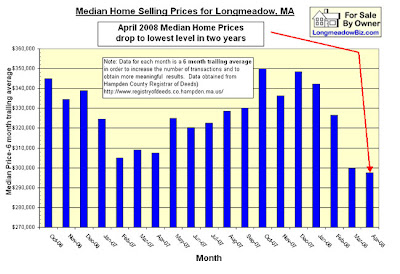

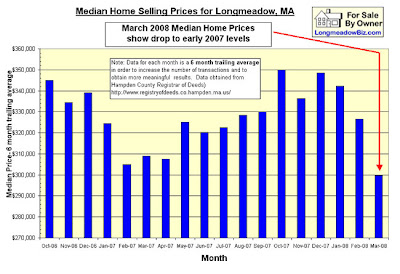

Median prices remained stable in November (see chart below). However, the current median price ($306,000) is still significantly lower (-12.9%) than the peak reached in September 2007 ($350,000).

[click chart to enlarge]

Current home inventory and sales figures indicate the average "time to sell" a home in Longmeadow remained at ~ 10-12 months.

Hopefully, all of the recent activity in Washington about reducing mortgage rates and helping stem the large increases in foreclosures will finally bring a bottom to this difficult real estate market.

Thursday, November 6, 2008

Reverse Mortgage Seminar

Topics include

"Shoul a Reverse mortgage be a part of your financial retirement strategy?"

"Medicaid issues relating to Reverse Mortgages"

"How does the interest rate affect the available proceeds?"

"Now or later - when should i consider a reverse mortgage?"

" Q & A"

Date: Friday Nov. 14th

Time: 11:00 am

Place: East Longmeadow Council on Aging

328 North Main St.

E. Longmeadow, MA 01028

Presented by: Flynt Lincoln, CAPS, CSA

Reverse Mortgage Consultant

Webster Bank

Tel. (413) 237-4653

Email: FLincoln@WebsterBank.com

Sunday, November 2, 2008

Longmeadow Home Sales- October 2008

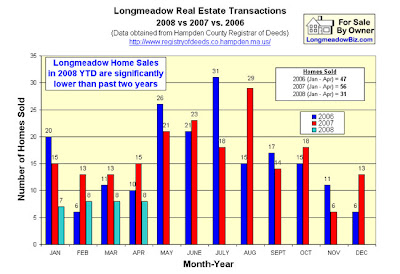

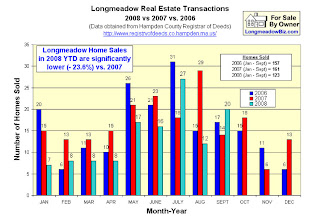

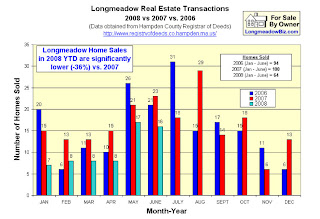

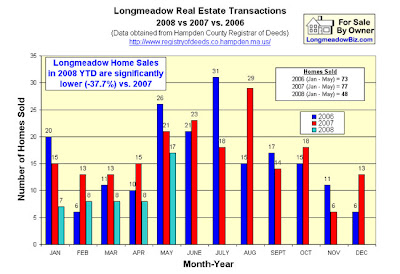

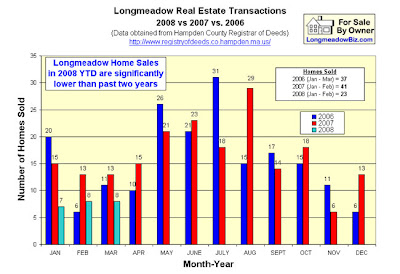

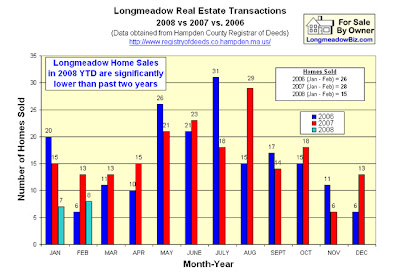

The bargraph below shows that the number of Longmeadow home sales from January through October 2008 were significantly lower (-21.8%) vs. results for the corresponding periods in 2007 and 2006 (140 transactions in 2008 vs. 179 in 2007 and 172 in 2006).

One bright spot is that home sales results for the latest four months (July through October) were only slightly lower (-3.8%) than the corresponding periods in 2007 and 2006 (76 transactions in 2008 vs. 79 in 2007 and 78 in 2006).

[click to view larger chart]

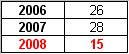

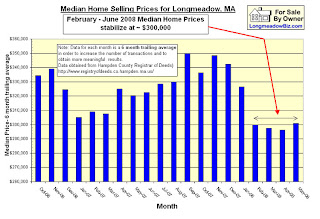

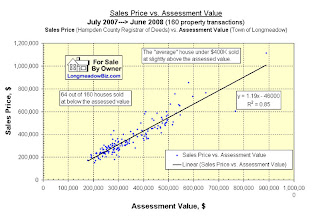

As shown in the chart below median prices declined in October to $305,000 from $315,000 in September. The latest sales data showed that 12 out of 17 homes were sold this month below the median price (Keep in mind that the calculated median prices are trailing 6 month results.) This change in median price was a significant decrease (-12.9%) from last year's peak ($350,000) and the data is similar to the national trend. In addition, 10 out of 17 homes were sold below the current Longmeadow assessment value.

[click to view larger chart]

[click to view larger chart]Current home inventory and sales figures indicate the average "time to sell" a home in Longmeadow remained at ~ 10-11 months.

All of the home sales data for these charts can be found at the Longmeadow-FSBO website.

Friday, October 31, 2008

Is it better to sell stocks or take out a reverse mortgage?

This question was recently posed to Suze Orman. The following link is a brief video of her response.

http://www.cnbc.com/id/15840232?video=903477657

If you'd like specific details if a reverse mortgage is right for you please call me at 413-237-4653.

Flynt Lincoln

Reverse Mortgage Consultant

Webster Bank

Friday, October 24, 2008

September Home Sales in Longmeadow

Sunday, September 21, 2008

Longmeadow- One of the Top Ten Places to Retire

Longmeadow was selected this week as one of the "Top 10 Healthiest Places to Retire" by the online version of the US News and World Report.Selection criteria was as follows:"These are places way ahead of the healthy living curve—they provide numerous places to exercise, promote strong social support, and encourage healthy lifestyle habits. And each has a little something extra, too."

Longmeadow was selected this week as one of the "Top 10 Healthiest Places to Retire" by the online version of the US News and World Report.Selection criteria was as follows:"These are places way ahead of the healthy living curve—they provide numerous places to exercise, promote strong social support, and encourage healthy lifestyle habits. And each has a little something extra, too." Saturday, September 13, 2008

Some good news for buyers and sellers!

No wonder the average person hasn’t got a clue as to what to do next. If you were thinking about buying a house and have good credit, you are probably sitting on the fence regarding the purchase given all of the uncertainty in the economy and the mortgage market. In some cases, you may have been unable to qualify for a mortgage given that banks have dramatically tightened up their standards.

If you have been trying to sell your house and it has been on the market for more than 6 months, you are probably getting pretty discouraged and very concerned about what to do next.

The article in today’s Springfield Republican reported that mortgage rates have dropped significantly (from 6.00 – 5.75%) in the past week as a result of the Fannie Mae/ Freddie Mac bailout and are expected to go lower. Local real estate agents have reported an increase number of phone calls and mortgage applications this past week.

There is a new feature on the Real Estate Buzz at LongmeadowBiz blog that tracks mortgage rates. If you are looking for a home, keep an eye on these rates because a lower mortgage rate will result in a significant drop in monthly payments and help improve the “affordability” of homes up for sale.

The drop in mortgage rates is good news for both buyers and sellers.

Thursday, September 4, 2008

Disappointing August Longmeadow Home Sales

[click chart to enlarge]

The above barchart shows that the number of Longmeadow home sales from January through August 2008 was much lower (-30.0%) vs. results for the corresponding periods in 2007 and 2006 (103 transactions in 2008 vs. 147 in 2007 and 140 in 2006).

In particular August home sales results were significantly lower vs. July 2008 (12 vs 27) as well as compared to August 2007 results (12 vs. 29). Current home inventory and sales figures indicate the average "time to sell" a home in Longmeadow has increased to ~ 10-11 months.

The only bright spot with these latest results is the continuing stability and slight increase in the median sales price for the past four months (see below) suggesting that we may be seeing a bottom forming for Longmeadow real estate market. The chart below shows that the median sales price (6 month trailing average) for homes sold during the past four months have stabilized at ~ $305,000 but it is ~ 13% lower than the peak value ($350,000) reached in September 2007.

Here is a link to the data for 2006-2007-2008 Real Estate Transactions that were used to develop the above graphs.

Friday, August 8, 2008

Pending US Home Sales for June Increase 5.3%

A previous post on this blog about pending sales for Longmeadow in May showed a healthy number (33) which was a good forecast of the latest July results.

The encouraging Longmeadow home sales report for July that I posted earlier this week looks like it may be part of a national trend.

Saturday, August 2, 2008

Longmeadow Foreclosures Are Increasing- Part II

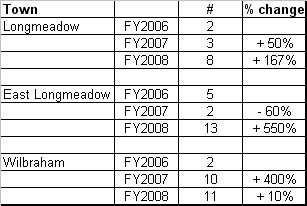

A second visit to the Hampden County Register of Deeds website found a summary of foreclosures by town for the FY2008 (ending 6/30/08) . Below is the data for Longmeadow as compared to East Longmeadow and Wilbraham.

Source: Hampden County Register of Deeds website.

Here is a link to the July 2008 summary written by Donald E. Ashe, Hampden County Register of Deeds

The reported increase in the number of foreclosures in Longmeadow is still a very low percentage of the total number of homes (8 out of 5500 = 0.15%) and should not be a concern to Longmeadow homeowners worried about their property values.

Some Good News for Longmeadow Real Estate

“Paulson Says Stimulus Worked, But Housing Still Correcting”

“US Housing Prices: When's the Bottom?”

“Worst Residential Real Estate Market Since Man First Walked on the Moon!”

“Housing relief bill unlikely to help those in most trouble”

The theme of continuing gloom and doom in the above news headlines continued to dominate the news media this past week and if you are trying to sell a house in this environment, it can get pretty depressing.

There is some good news in the latest July sales results for Longmeadow.

As shown in the chart below the number of Longmeadow home sales increased dramatically to 27 in July from 16 in June. Comparison of July results from one year ago also showed much stronger home sales results (27 vs. 18). However, because of the weak results for the first six months of 2008, 2008 YTD results are still down 23% vs. 2007 YTD results.

[click to enlarge]

As shown in the chart below there are some encouraging signs on median prices where for the fourth consecutive month the median sales price remained stable at ~ $300,000.

[click to enlarge]

Some housing experts have indicated that the first signs of a bottom in the housing crisis will be price stabilization and increased home sales. In Longmeadow, it appears that this is happening…. Hopefully, this is the beginning of the return of some normalcy to our local real estate market.

Stay tuned for further developments by visiting Real Estate Buzz at LongmeadowBiz.

Saturday, July 26, 2008

Longmeadow Foreclosures Are Increasing…

This above data is incorrect... see post entitled "Longmeadow Foreclosures Are Increasing- Part II" for correct numbers.

There are currently ~ 136 houses in Longmeadow up for sale (116 MLS listing + ~ 20 FSBO’s). This is a typical number for this time of the year during the past three years.

There are approximately 5500 homes in Longmeadow so currently in 2008 ~ 2.5% of the homes are up for sale and less than 0.1% have been foreclosed by the lender.

However, there are some real estate FACTS that are sobering….

1. Longmeadow 2008 YTD Housing Sales are down 36% vs. last year (for the first six months in 2008- 64 homes were sold vs. 100 in the first 6 months of 2007).

2. The 2008 YTD median price in Longmeadow is down ~ 17% over the past year (360K vs. $300K).

RealtyTrac.com- one of the most cited websites for foreclosure information- shows 19 foreclosure listings for Longmeadow. However, these listings usually represent a notice of foreclosure to the owner and many of these situations are resolved without foreclosure.

Touting 19 properties in Longmeadow as foreclosures is like quoting $5.3 trillion dollars as the potential downside risk to the taxpayers for the bailout of Freddie Mac and Fannie Mae…. not all of the mortgages guaranteed by these GSE’s are going into foreclosure and even if they did they still would have some value.

If you are interested in staying connected with the FACTS come back and visit Real Estate Buzz at LongmeadowBiz. Here is a link to the latest stats for Longmeadow.

Friday, July 25, 2008

Will Your Home Stand Out In The Crowd? Selling confidently in today's market

Selling a home is not much different than selling anything else. You must PREPARE it well, PRICE it competitively, and PROMOTE it to your market. We call this the THREE "P's".

If you choose to use a real estate agent to market your home, it will be his/her job to get the word out. This usually involves putting the listing on the MLS and on other Internet websites, putting an ad in the local paper, sending some postcards to your neighbors and possibly hosting an open house. By outsourcing the promotion, you will pay between 5 - 6% of the sales price of your home...assuming that it sells! If you choose to take control and sell "by owner", you will be promoting your home yourself and you will form your own marketing strategy.

If you have done your homework in the first two areas, promoting your "product" to a wide buyer pool is the key to your success. Quality marketing and advertising that makes sure your home stands out in the crowd will create a strong statement to buyers, giving them confidence to work with you. It will create value for your home, further enhancing your credibility. Expect to pay a reasonable amount to advertise your home and look for results oriented marketing that will reach buyers where they're looking.

First impressions count. Will your yard sign come from a hardware store and look generic, leaning precariously on your front lawn, the faded magic marker telephone number barely visible? Will your information sheets look professional and grab buyer attention?

In our years of helping private home sellers learn the ins and outs of marketing their homes to the public, we've seen more bad yard signs than we can count, and learned of countless ways that sellers have missed important opportunities. Does that mean you can't sell successfully without using a real estate agent? Heck no. It just means you need to educate yourself about the process and make sure you start off on the right foot.

Remember, your home's appearance and your choice of marketing is a reflection of it's owner. Do you want to appear cheap, like you don't know what you're doing, and possibly difficult to work with, or do you want to greet qualified buyers at your door with confidence? The choice is yours.

Thursday, July 24, 2008

Existing home sales continue slide

A report from Bloomberg.com this morning on the latest existing US home sales showed disappointing results and no end to the current housing problems...

Sales of existing homes in June dropped 2.6% to 4.86 million (vs. 4.99 million in May and estimated 4.94 million)

18.6 million houses, apartments and condos were vacant during the last three months. Median prices have dropped 6.1% in the past year.

Here is a link to a video interview with Rebecca Braeu, a economist/ real estate analyst with John Hancock Financial Services who sees this latest data as troubling sign for the fragile housing market.

There is some help on the way from Congress with financial fixes being planned for Fannie Mae and Freddie Mac- the giant mortgage guarantors to help improve the availability of mortgage money. In addition as much as $4 billion in grants will become available for communities to use to purchase foreclosed properties. The bill in Congress is expected to become law by next week.

Read the full story on Forbes.com.

Friday, July 4, 2008

Vacation Rentals

If you have a vacation home and are looking to rent it, there is a low cost advertising option at LongmeadowBiz.com. For only $50/year, we will design and host a webpage on LongmeadowBiz including photos, rental details and more. Periodic updates (e.g., changing photos- summer vs. winter) are included with the annual fee.

If you have a vacation home and are looking to rent it, there is a low cost advertising option at LongmeadowBiz.com. For only $50/year, we will design and host a webpage on LongmeadowBiz including photos, rental details and more. Periodic updates (e.g., changing photos- summer vs. winter) are included with the annual fee.Tuesday, July 1, 2008

Latest Longmeadow Housing Stats

[click to enlarge]

[click to enlarge]June showed 16 houses sold vs. 23 in June 2007 continuing the trend that has been observed in 2008. For the first six months of 2008, home sales are down 36% vs. the corresponding period in 2007 (64 vs 100).

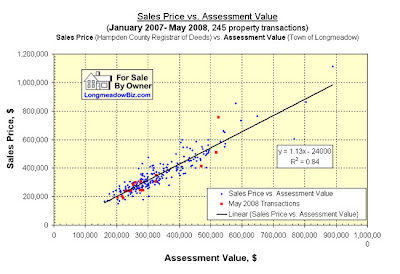

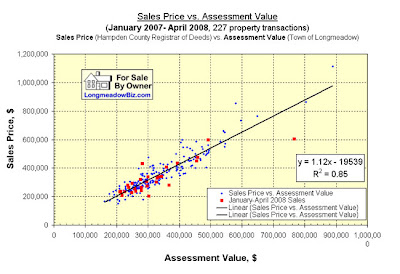

Sales prices over the past year have correlated pretty well with official assessment values. The average house under $400K has sold at slightly above the official assessment value. 64 out of 160 homes that have sold in the past year have sold at less than the official assessment value.

With year to date sales of 64 homes and a current inventory of ~ 125 homes for sale, the average time to sell a house is now approaching 12 months- certainly not a robust sales environment not matter how you evaluate it. The other watchout is that there are many people in town who have withdrawn their homes from sale and are awaiting the beginning of a better sales climate. When housing market improves, the inventory of homes for sale will likely increase significantly.

Details of Longmeadow Real Estate Transactions for the past two years (2006- 2008) that are used to generate the above charts can be found here.

Hopefully, the report next month will show some better results and some signs of a housing recovery in Longmeadow!

Monday, June 16, 2008

Protect Your Privacy When Selling Your Home

Not too long ago, one of our home sellers told us of a frightening experience he had when his home was under a listing agreement with a local agent. As a result of the incident, he canceled the agent's contract and took matters into his own hands. Here's what happened:

Thank goodness that the ending was uneventful, but it does point to the need to take privacy issues seriously when selling your home. With a lock box on your door, ANY agent can access your home at ANY time with ANY client. Remember your lock is on the outside of your home. You won't know when you leave in the morning if people are coming or who was there when you return later. You won't know if you left something valuable on your dresser. You just won't know.

When you sell privately, it's just that -- private. You determine who you will show your house to and when.

Monday, June 9, 2008

Pending Home Sales

It should be noted that this data is for April not May and is not as much of a leading indicator as it could be if the data reported was more current. The “sales pending” number of 33 for Longmeadow that I reported in my previous post was as of June 5- not April 30.

There are a couple of interesting points from the reports that I read earlier today…

“Bargain hunters have entered the market en masse, especially in areas that have experienced double digit price declines, but it’s unclear if they are investors or owner-occupants.” – Lawrence Yun, National Association of Realtors

Data from a recent blog post, showed that over the past seven months Longmeadow’s median sales price has dropped from ~ $350,000 to ~ $296,000- a 16% drop.

Many observers have predicted that we will be at the bottom of the housing crisis when home prices stabilize.Again, in a recent blog post the median sales price for Longmeadow seems to have stabilized at ~ $295,000 – $300,000 for the past three months.

Perhaps, we are at the beginning of the recovery for home sales in Longmeadow….. stay tuned.

Saturday, June 7, 2008

Is it time to buy in Longmeadow- Part II?

Even though the sales data that I provide on a monthly basis is more current (earlier this week I reported Longmeadow 2008 sales figures through May 31) it still does not provide current enough information since most transactions that were reported were in process for at least 4-8 weeks.

In our April Sales Report… Good News/ Bad News post we reported seeing numerous “SOLD” and “Sale Pending” signs around town that seemed to indicate that buying activity was picking up. While the May 2008 results were up vs. April 2008 (17 vs. 8), corresponding May 2008 results vs. May 2007 were disappointing (17 vs. 21).

We have now identified a new statistic that might provide us a good leading indicator…. it is called "Sales Pending". According to MLS PIN , there were 33 Longmeadow homes in this category as of June 5 which confirms our “around town” observations. This data includes MLS sales but does not include FSBO sales which are usually are 10% of the total.

Given that there were 23 homes sold in June 2007 and 18 sold in July 2007, this latest Sales Pending data suggests a fairly active sales season for the upcoming summer as compared to last year.

Last week’s sales report also showed that 10 out of 17 homes sold for less than the official town assessment value with the median sales price at a two year low. While the current environment for obtaining a mortgage is more difficult, qualified buyers can still get one. And interest rates are still low on a historical basis.

I suggested in a post earlier this year, that 2008 might be a great time to buy a house in Longmeadow.

So….. it is still probably a great time to buy a house in Longmeadow.

Also, if you are thinking about selling your house.... don't wait too long. I suspect that once the word is out that houses are again selling in Longmeadow.... that there will be a wave on new properties being offered for sale. Consider selling your house via FSBO in order to be able to price it for today's "buyer's market".

Longmeadow FSBO

Friday, June 6, 2008

Mortgage Truth

By Tim Ryan, President

Ryan Mortgage Group, Inc.

Longmeadow, MA

Prime mortgages have now been credited for bankrupting well over 110 lenders and seriously damaging operations at many major mortgage firms. They've reportedly wiped out 5 hedge funds, tens of thousands of jobs, and have led to millions of foreclosures with millions more on the way. And, as if that weren't enough, subprime mortgages are also blamed for massive volatility in the stock, bond, credit, futures, and real estate markets here in the US and around the globe. Some say losses in the mortgage securities market alone could reach hundreds of billions of dollars this year. This means that, for any Americans looking to buy, sell, or refinance a home, they are confronting a very different market from the one that existed just 6-12 months ago. How did this happen? The recent real estate boom was fueled by a period of record home appreciation and historically low interest rates. Banks, in order to compete, loosened guidelines and began offering more funding to more borrowers through riskier, non-conforming or "exotic" mortgages. These ideal lending conditions persisted for several years, supported by high demand, historical real estate data, home prices, and massive trading volume/profits on mortgage-backed securities and other financial instruments on Wall Street. Then, in 2006, a slowdown in real estate led to a deterioration of home values, an increase in inventories, and ultimately to today's tightening of credit guidelines, leaving many investors unable to sell or refinance out of their existing positions. Many Americans who had tapped into their equity were suddenly tapped-out and overextended as home values fell. Foreclosures followed in record numbers and a re-valuation of mortgage bonds and other financial instruments created the credit/liquidity domino effect we're now experiencing. Unfortunately, it's going to get a lot worse before it gets better. According to the latest estimates, over 2 million subprime and Alt-A adjustable rate mortgage (ARM) holders will face payment increases of up to 30%-100% when their loans reset in the next 2 to 18 months. These loans make up less than 40% of the total mortgage market, but the negative effects, as we have seen, of increased foreclosure activity can have a ripple effect throughout the industry and around the globe. What does this mean to you and your mortgage? Sellers: If you're planning on selling your home, be prepared for an even smaller pool of qualified buyers. While some experts predict a settling of this credit crisis over the coming year, tightened credit guidelines and diminishing mortgage products could knock out as many as 15%-30% of potential qualified buyers. Now is not the time to sit and wait for the best possible price. Have a serious talk with your real estate agent. Having experienced buying/selling transactions in your area, he or she can help you price your home accordingly. He or she can also help ensure that your buyers are pre-approved and stay pre-approved throughout the entire transaction.Buyers: Get pre-approved by your mortgage professional. While there are a lot of great deals out there, getting credit is becoming tougher and tougher, and it's taking longer and longer to complete a transaction. Remember, what you qualify for today could change tomorrow in a volatile market. For those looking to refinance, keep this in mind. There is no time to delay! Communicate with your lender. Don't do anything that could negatively affect your credit, and make sure you get all your documentation in on time. ARMs Borrowers: If your ARM is scheduled to reset in the next 2-18 months, you need to schedule an appointment with a mortgage professional right away. Whether your ARM is subprime, Alt-A, or even if you have a pre-payment penalty, don't let a default or foreclosure situation sneak up on you. Did you know that your monthly payments can increase anywhere from 30% to 100% once your loan resets? At the very least, give yourself the peace of mind of knowing what your adjusted payment will be. Borrowers with less-than-perfect credit: Each week it seems lenders are shedding more and more mortgage products. Many lenders have stopped offering No-Doc loans and are reducing all forms of Stated-Income loans. While it might be challenging, borrowers with credit issues need to see a loan expert. Often they have credit repair resources and other strategies to help you reach your financial goals. Finally, there's an important concept to embrace: all markets, while cyclical in nature, are self-correcting, be it credit, real estate, stocks, or bonds. For the last 6 or 7 years, real estate was booming and riding high. The correction we're experiencing now – while it seems harsh and could get much worse – is, in a sense, "natural" and directly related to the extremely loose guidelines and perhaps overzealous lending and leveraging during the boom cycle.

Tim Ryan is President of Ryan Mortgage Group, a Licensed Broker in MA, CT & FL . For a free consultation or more information about the mortgage market, contact Tim‘s Team at 413-567-1040.

Sunday, June 1, 2008

Latest Longmeadow Home Sales

Home sale prices also continued to follow the trend established earlier last year in which they correlated pretty well with assessed property values. In May 2008 10 out of 17 homes sold for less than the current assessed value.

Thursday, May 15, 2008

UNDERSTANDING CREDIT SCORING

Understanding Credit Scoring & Credit Repair

By Timothy P. Ryan, President

Ryan Mortgage Group, Inc.

East Longmeadow, MA – Credit remediation is a subject consumers often face with fear and trepidation, and for good reason. With the exception of recognizing that the best score wins, the average home shopper knows very little about the whole credit scoring process. Sub-prime borrowers who are eager to move into A-Paper territory often find themselves at a loss when trying to find ways to upgrade their credit history. The good news is there are ways to improve less-than-perfect credit scores and obtain a loan for the home you really want.

The first step in the process is making sure that you have a current copy of your credit report. Congress recently amended the Fair Credit Reporting Act so that consumers may now receive one free credit report annually. There are three major credit bureaus: Equifax, Experian, and Transunion. Since entries can vary across bureaus, you’ll want to request a free report from each of the three companies. (Go to www.annualcreditreport.com)

It's also important to know just what a good credit score is. Most A-Paper scores generally begin around 650, although this number may differ slightly among lenders. Don't despair if you come up shy; there is always room for improvement. Increasing your score just 5 points can save a significant amount of money. For example, if your score is 698 and you increase it to 703, then you could save yourself thousands of dollars over time as a result of a slight improvement to your loan’s interest rate.

While credit repair is necessary for some, it's not the only way to increase your credit score. Even if you have stellar credit, you can enhance your score through these steps:

· Evenly distribute your credit card debt to change the ratio of debt to available credit. Let's say you have a credit score of 665. If you have debt on only one card, and four additional credit cards with zero balances, evenly distributing the debt of the first card could move you closer, and possibly into, that ideal bracket.

· Keep your existing accounts open and active. The average consumer is usually anxious to close credit card accounts that have zero balances, but doing this can cause them to lose the benefits of a long-term credit history and increase their ratio of debt-to-available credit. The bottom line is don't close those old accounts!

· Keep credit inquiries to a minimum. Each inquiry into your credit history can impact your score anywhere from 2-50 points. When it comes to mortgage and auto loans, even though you're only looking for one loan, multiple lenders may request your credit report. To compensate for this, the score counts multiple auto or mortgage inquiries in any 14-day period as just one inquiry, so try and stay within that time frame.

Remember, credit scores don't change overnight. Improving them requires time and diligent effort on your part, so it's a good idea to get the ball rolling at least three to six months prior to submitting your application for home financing.

If credit repair is what you need, you can either begin the process yourself or seek out a repair service. If you decide to make your own improvements, visit as many websites as possible to get information regarding credit laws and consumer rights. Diligently search through them and educate yourself to ensure that you don’t sustain any self-inflicted wounds. A good place to start would be the Federal Trade Commission's website, which contains a wealth of helpful literature.

If you’re facing severe or complicated credit issues, then you’ll probably want to enlist the assistance of a professional credit repair company. Before you do, be sure to familiarize yourself with the FTC's regulations on credit repair. With over 1100 credit repair companies to choose from, it's important to be certain you are dealing with a reputable firm. Examine the FTC's information on fraudulent practices to avoid falling prey to credit repair scams.

Addressing credit issues can be uncomfortable to say the least. But by taking these steps now, you’ll be that much closer to obtaining the home of your dreams.

Additional Resources:

To order your free credit report, go to:

http://www.annualcreditreport.com/

To read the Fair Credit Reporting Act, go to:

www.ftc.gov/os/statutes/frca.htm

For the Federal Trade Commission's information on consumer credit, go to:

www.ftc.gov/bcp/conline/edcams/credit/index.html

Tim Ryan with Ryan Mortgage Group, Inc., a Licensed Broker in MA. If you would like to obtain a free Consumer Credit Scoring Booklet, please contact Tim Ryan at 413-567-1040.

Thursday, May 1, 2008

April Sales Figures...Good news/ bad news

There have been days in the past …even in the most recent past six months- when the stock market has been down “big time” with the DJIA down triple digits. During these periods of time I just cringe and don’t want to know what’s happening because it is so depressing- thinking about all of the paper $$$ losses and not being able to do much about it. At the same time the various CNBC “talking heads” predict another 20% drop in stock prices and I just keep thinking about the still larger drop in my stock portfolio. Psychologically, I want to sell everything at any price and limit my losses. However, one thing that I have learned from over 30 years of investing in the stock market is that a contrarian point of view with a long term prospective is a good strategy. Large declines in the stock market point eventually lead to bargain prices with upside potential gains…. Remember the long time investment adage “big low… sell high”. However, in the heady days of the tech stock market boom, some stocks got way too high and dropped precipitously…. and haven’t come close to recovering… even after more than five years. However, solid performing stocks have recovered nicely.

I believe that the same thing will become true with the current real estate market. There are obviously overheated markets (e.g., Florida, California) where home price appreciation reached absurb levels and now these areas are correcting sharply. These markets may never again see prices as high as they have been. Too many new homes with steep price tags were built and there were not enough buyers who could really afford them. Now with the sub-prime mortgage problems and the accompanying foreclosures, short sales, etc., there are many homes becoming available with more reasonable price tags. Again, the “talking heads” are calling for greater price declines before it is over, but given our country’s demographics, there is likely to be a strong long term demand for housing at a reasonable price in the future. The inevitable drop in home prices that will occur over the next 6 months - 2 years will be uneven but will present opportunities for both buyers and sellers.

Now for the latest Longmeadow state of the housing market…

Walking around my neighborhood and driving around town recently I know of at least 10 homes that have been “sold” and will likely close in May or June that are not included in these latest sales figures. In addition, a local realtor told me recently that she had sold 5 houses in the last two weeks and was involved in one sale that involved 5 bids with the final price significantly higher than the asking price. Using the recent past home sales figures (or stock market performance) to predict the next 6 months – 5 years is akin to driving a car using the rear view mirror. While we are obviously not ready to declare that the Longmeadow real estate market has become a “seller’s market”, there are signs that maybe some improvement is in the making. One interesting comment in the April 24 Springfield Republican article by Susan Renfrew, President of the Massachusetts Assn. of Realtors was interesting: “people selling in this market also need to remember they’ll end buying their next home in the same market”. Let’s hope that by late summer/ early fall some sense of normalcy will have returned to our Longmeadow real estate market.

Tuesday, April 8, 2008

Selling A Home: Challenge #1 - Controlling Clutter

Selling a home can be challenging and stressful! Often sellers have asked us, "What's the hardest thing to do when selling "by owner?" The answer to this question may surprise you. Whether you are using an agent or selling "solo", you still must prepare your home for the market. That said, we have worked with Western Massachusetts home sellers for over six years and the most difficult challenge sellers have told us they have had is GETTING RID OF CLUTTER. Sound familiar? If you need some help in this area, keep these thoughts in mind:

Selling a home can be challenging and stressful! Often sellers have asked us, "What's the hardest thing to do when selling "by owner?" The answer to this question may surprise you. Whether you are using an agent or selling "solo", you still must prepare your home for the market. That said, we have worked with Western Massachusetts home sellers for over six years and the most difficult challenge sellers have told us they have had is GETTING RID OF CLUTTER. Sound familiar? If you need some help in this area, keep these thoughts in mind:• Less clutter = bigger looking rooms = more money!

• Less clutter = less you have to pack, or worse, pay a moving company to transport!

• Less clutter (knick-knacks, photos, treasures) = more a buyer can imagine how their clutter will look in their new home!

How do you start controlling the clutter?

• Take it one room at a time - main rooms first. As you de-clutter, stage the room and take pictures for your slide show while it looks its best.

• Use contractor's trash bags - they hold more stuff and are very durable

• Donate to your local Goodwill or Salvation Army. Your stuff will go to a good home

• "Build the buzz" - have a "moving sale" and hand out New To Market flyers

• Make a checklist for quick clean ups before showings. Remember, when you sell by owner you don't have to clean up ever day just in case someone stops by - big bonus!

Remember, the time you take now to make your home squeaky clean and show ready, will pay off later as your home outshines the competition.

Thursday, April 3, 2008

Tuesday, April 1, 2008

Slow Home Sales in March

[click to enlarge chart]

In addition, the median price (6 month trailing average) fell to its lowest level since early 2007.

The above results are certainly not great news for those selling their homes. They suggest that further price attrition will occur before home sales increase.

However, next year we may all look back at this point in time and determine that 2008 was an excellent time to buy a new home.

Wednesday, March 19, 2008

Short Sales

There is a lot of talk these days about short sales. Many people looking to make a move find that they cannot afford to sell their homes at current market values. Following is an overview of the short sale process directed primarily toward Realtors and anyone using their services in a short sale.

SHORT SALES DEFINED

It is the negotiation between the Seller and the Seller’s Lender that is the focus of this article with particular attention paid to the interaction between the Seller, Realtor and the Real Estate Attorney. Although Short Sale Transactions have become easier in some respects, short sales are still time consuming, resource hogging, stressful transactions that can be a real gamble for the real estate professional who accepts the challenge of listing a short sale property. It is only through preparation and good communication that these transactions can reach happy results for all parties involved.

WHY IS THE SELLER LISTING THEIR PROPERTY WHEN THEY WILL BE SHORT?

Many times the Seller is unsure of whether or not their sale will be a "short sale". All that they know is that they must sell immediately. There are entire categories of Sellers who need to sell quickly for a variety of reasons, for example: to relocate for a job, marriage, school, death of a spouse, or other family obligations. These Sellers simply must sell now regardless of the short- fall. Therefore, it is critical that the realtor takes the time to review all of the Seller’s obligations and costs that will effect the sale of the Seller’s real estate when listing the property. This evaluation is something that a realtor would likely perform under normal circumstances. When working with Sellers in these categories, your calculations may point toward a shortage of funds. It is then important to take great care when the numbers are "close", to properly determine whether or not the sale will be short.

In the majority of cases, however, it is the Seller’s inability to pay their current mortgage obligations and Seller’s lender’s foreclosure efforts that bring the Seller’s "short sale" listing to the realtor. Sellers may have already run through some of the alternatives discussed below before seeking assistance as a Realtor to list the short sale property. Time may be a critical factor in listing the property, selling the property and negotiating with the Seller’s Lender before an auction date. This is why a quick and thorough evaluation of the Seller’s debts and costs of closing is necessary and why preparation for and knowledge of the negotiation process with Seller’s Lender are important.

Under some circumstances a short sale will not be of any help to the Seller. As successive layers of liens of all types are placed on the real estate by creditors, the likelihood of settling with all of the creditors in a timely fashion diminishes. If a Seller has not paid their mortgage, it is very likely that they have not paid their credit cards either. . . Depending on what the Seller’s financial picture looks like, the other options listed below may be more appropriate. It is a good idea to talk with a real estate attorney about all of the Seller’s options once you have gathered all of the Seller’s financial information.

OPTIONS OF SELLER WHO HAS FALLEN BEHIND IN MORTGAGE PAYMENTS

1. Do nothing: Bank forecloses, new owner or bank evicts borrowers. Bank files suit to collect deficiency (amount between what is owed and what the property sells for at auction.)

2. Deed in lieu of foreclosure: Deed property to bank and Seller is forgiven any amount owed that is over the value of the property. Seller must immediately vacate the property. This option has a negative effect on credit, but not as negative as the bankruptcy option below.

4. Bankruptcy: This option may be useful if there is equity in the home to slow down the foreclosure action. If there is really no equity then the a subsequent sale will still be a short sale and bankruptcy may not be a viable way to stop the foreclosure. Bankruptcy also can have a devastating effect on a borrower’s credit.

5. Short Sale: Short sale allows property to be sold, all taxes and all utilities and other debts associated with the property to be paid. The effect of a short sale on Seller’s credit is not as negative on Seller’s credit as deed in lieu of foreclosure or the bankruptcy options above. The short sale may have a tax consequence.

SHORT SALES NOW AND THEN

Historically short sales have been difficult propositions for the real estate professional and generally have been viewed as transactions to be avoided. Beyond the unpleasantness of being involved with a sale that will produce no proceeds for your client, there is also no money to help the transaction move forward, i.e., any repair credits or other Seller concessions cannot be offered in order to keep a transaction together. These transactions are generally difficult and a gamble as far as getting approval from the lender. In the past, lenders often looked to the other real estate professionals to take a cut in their fees and commissions in order to make the short sale transaction happen.

Recently the market has shifted and many lenders have restructured their loss- mitigation departments to handle larger volume of requests for "short sales". This has increased the flexibility that lenders have in settling the short sale negotiations, has made them faster in many cases and less demanding of the processionals involved.

One of the lessons that lenders have learned in this market over the past two years is that they can sell the property for what the market will bare before the foreclosure through a short sale or they can go through the expense of the foreclosure, legal fees, auctioneer fees, the expense of maintaining the property if the lender buys at its own auction, and the expense of listing the property with a realtor, only to find months later that the market has further declined and that the short sale opportunity prior to the foreclosure would have netted far more than the final sale.

THE BASIC STEPS OF A SHORT SALE

1. Setting sale price at market rate - You must determine the fair price to sell the home and be prepared to defend this price. Helpful if you have the listing for a long period of time and can show other properties selling for listed price.

2. Gather information for Lender’s "Short Sale Package" use checklist

3. Get offer to purchase signed by all parties (use an addendum for offer and contract) have any short sale contract reviewed by an attorney or title company assisting you with the short sale

4. Provide attorney with all gathered information from checklist so that attorney can apply for the short sale package

5. Attorney prepares short sale package for Lender with assistance of Realtor. It is extremely important that the realtor is available to show the property to Lender’s agent who is producing the Broker’s Price Opinion

6. Lender sends agent to produce a "Broker’s Price Opinion"

7. Short sale is approved through a certain date

8. Negotiations can continue as situation changes through sale date (examples to follow)

NOTE: The short sale approval phase of the "short sale" process can take anywhere from six to eight+ weeks. It is extremely important to determine where your Seller is in relation to the collections efforts of the Seller’s Lender. You need to know and verify in writing whether you client has missed one payment or if the auction is scheduled for next week in order to advise the Seller to take the correct next action.

WORKING WITH DEBTORS

Many times people who are in debt lose track of all of the bills that they owe, many of which effect the proceeds of the sale of their property. It is important that the Realtor is aware of the mortgages on the property, along with any other liens. In addition to mortgages and liens that are on record at the registry of deeds, the Realtor should be aware that taxes and municipal services such as water and sewer, and in some cities and towns, gas and electric are charges against the real estate that may be seriously delinquent.

Often times debtors are emotionally devastated over the prospect of losing their home. Many times they do not even know how long they have until their property will be auctioned or what their debts are that effect the property. They need someone to take control of the situation. If you do not take control, you may find that you waste a great deal of effort and energy.

To make the point about wasting time, I would just like to relate a quick story: In July of 2007 I was working with a Buyer who was purchasing a two family in Springfield, Massachusetts. My client had signed contracts, paid for her inspections and an appraisal on the property and was in the midst of negotiations over some repair issues. The Sellers were not budging on a couple of repair issues and I was working with her to help reach some compromise as we extended the inspection dates on the contract. My client happened to work at the water department in the City of Springfield and she was aware of adjustment issues that sometimes take place regarding municipal liens on properties. In the midst of the negotiations over repairs she had checked the title and called to ask why a deed had recently been recorded. As it turned out, the property had been sold at auction in May! The Sellers did not know that they no longer owned their home. Imagine the frustration if you had listed that property, shown that property, finally got the property under contract, frantically trying to keep the deal alive during inspection negotiations, only to find that your Seller does not own the property! How could this happen? It is simple: Debtors lose control of their bills, they get depressed, they do not open their mail, they really need your help. . . .

Attached is an intake sheet showing what you as the Realtor can help gather in order to get a jump on what you will need to complete the short sale what you need to gather:

NOTE: There are three reasons that the Realtor will want to gather complete and accurate material as shown in the checklist, prior to listing the property:

1. To evaluate the likely success of a short sale.

2. To prepare the Lender’s short sale package

3. To provide the Broker performing the Broker’s Price Opinion with all of the information that they need to fairly value the property (agree with your sale price!)

GET AN ATTORNEY INVOLVED

Work with the attorney as early as possible - even prior to listing the property. Most real estate attorneys will take the time to go on line with you over the phone and run down the property to help you assess the value of the mortgages and any other liens on the property. A real estate attorney will also assist in reviewing the current tax status of the property. More importantly, a real estate attorney can begin to gather the required information for the short sale, beginning with a "short sale package" from the lender.

Attached are a couple of short sale package agendas that we have received over the past year. Note that they can be as brief as one page or they can be ten pages long!

The real estate attorney should also help with the purchase and sale agreement and answer any questions regarding special language that should be contained in a short sale purchase and sale agreement. On occasion the usual language regarding Seller's representation must be changes as this is a short sale and there is an expectancy of a shortage of funds. Many contracts contain provisions where Seller certifies that there is no expected short fall. Attached is some language used in Massachusetts contracts that you may want to use:

Just a general note on the short sale package: What we are trying to do is to provide the most information possible to the lender that will convince the lender that our deal should be accepted. This is where a complete package with additional repair and picture information helps to make the case for the short sale. The short sale application usually requires the following:

· Authorization to Release Information (homeowner’s permission for the bank to speak to you)

· Purchase and Sale Agreement

· Hardship letter (showing why the homeowner can’t make the mortgage payments)

· Financial statement (showing the assets, liabilities, incomes & expenses) includes taxes, pay-stubs, bank statements

· Estimated HUD1 or Net sheet (showing the bank what they will get at the time of sale)

MAKE A GOOD DEAL

It may seem obvious, but as always, the transaction will fail if the Buyer and Seller do not agree on all of the terms. One of the unusual terms that are part and parcel of a short sale is the extended closing date. The Buyer must be willing to accept a closing date at least six weeks away from the date the contract is signed.

The Buyer must also be willing to accept the property with limited concessions. There may not be time for extended inspection generated requests for repairs or closing cost credits. While it may be possible to allow a credit for a major repair or closing costs, these items can make it difficult for the Lender to accept. . . anything that effects the bottom line to the Lender will be treated as though you devalued the offer made to the Lender. The Lender is paying for these costs, not the Seller.

There are investors who attempt to buy property through short sale listings. There are investors who will place more than one offer on different properties while only intending to purchase one. It is very important to avoid such Buyers.

The bottom line is that you need to have GREAT Buyers. Large deposits and firm commitments to this extended process are very important. At the same time, you need to have the ability to look for backup offers in case you have a Buyer back out under the contingencies in the contract. Buyers with weak credit that cause you to re-list the property in week four of this process, because their mortgage commitment falls through, can cost you the sale.

THE BROKER’S PRICE OPINION

Once the Lender has received the short sale application, the next phase of the approval process is the Lender’s independent verification of the value of the home based upon its condition and market conditions in the neighborhood in which the subject property is located. This is usually accomplished through the Lender or an agent of the Lender contacting a licensed real estate broker’s office requesting a "broker’s price opinion". This is the critical phase of the entire transaction. If the Broker’s price opinion values the property higher than you have sold the property, the Lender may deny the short sale application, believing that the property would yield a higher payoff at auction.

The key to successfully navigating this phase of the transaction is to control the broker’s price opinion. The fate of the Short Sale is in the hands of another Realtor.

There is a human factor to these Broker’s Price Opinions that cuts both ways. The relatively low pay that a Realtor receives for producing a BPO ($75.00 - $90.00) relatively complicated report on your property cuts in favor of a quick look at the property by the other Realtor. There is only so much time that a Realtor is going to put into a BPO for $75.00! The fact that you will have gathered all of the material that the other Realtor needs (comps, repair reports, information about the neighborhood) cuts in favor of the other Realtor using your information or at least checking their work against yours and hopefully agreeing with the value that you based the sale on.

The successful short sale Realtor controls the BPO. Beginning with the initial letter to the Lender it is important that the Listing agent makes it clear that she alone should be contacted for the house to be shown to anyone for the BPO or appraisal of the home. It is my practice to provide all of the listing agent’s contact information to the Lender, indicating that only the Listing agent is available to allow access to the home. When the Realtor is called, she should immediately assist the Realtor conducting the BPO by emailing or faxing all of the information that she has gathered for the short sale package. The Realtor should bring a copy of the short sale package and any other information that the Realtor has in order to influence the BPO. The key is to make the other Realtor’s job easy by providing all of the research to her. It does not hurt to quickly run through the hardship issues of your seller either and how badly they need this short sale to go through. Tell them why you set the sale price at the price that you sold the property and why you think it is fair given all of the circumstances and the data that you have gathered. No one is going to argue with you too long for $75.00!

If you are unable to make contact prior to the showing of the property, be sure to bring the following with you and provide them to the Realtor conducting the inspection:

- Photographs of the home, highlighting any imperfections inside and outside

- repair list

- any quotes for repairs

- inspection reports

- taxes and utilities owed

WHEN THE SHORT SALE APPLICATION / OFFER IS REJECTED:

Work with the attorney if the short sale is rejected. We need to find out why. If the BPO shows a higher value that is not justified then we need to request that a second opinion be rendered and again submit all information showing why the valuation should be lower. Ask for information - what comps did the agent use? Are they valid? Did they take into consideration the repairs?

You might consider paying for a second BPO ($75). If first was a drive-by - insist on meeting the agent at the property with your package and try again. Another option is paying for an actual appraisal. If your client is willing to pay and you firmly believe that your pricing is correct and the Lender holds out a glimmer of hope that it would be helpful. . . you may want to have your Seller pay for an appraisal. Many Lenders will listen to what you have to say and they will reconcile the second BPO’s and / or appraisal against the information that they have already received.

WHAT IF YOU GET AN APPROVAL BUT YOU ARE STILL SHORT?

Ask again. As it turns out, asking is mostly free. The only time that you can ask the wrong question in my experience is in Court. That’s another story. With short sales, you sometimes have to go back to the well a second time if a lien arises that was not previously on record or if the Seller suddenly reveals that they have no where to go an they need first and last month’s rent. - This actually happened to me and I was able to get another $1800.00 from a Lender so long as it was paid directly to the new landlord! The Lender will have made their decisions as to what the lowest price they would accept in a short sale negotiation based upon the BPO and other factors and your second or third short sale offer of settlement may be well within the Lender’s guidelines. . . so ask away!

FINAL NOTES:

These are better times to be involved with short sale transactions. The banks need your services and are willing to allow the real estate professionals involved in these transactions to earn full commissions and increased legal fees! Just remember the following key concepts and your short sale should go smoothly:

1. Do your homework - verify status of foreclosure and evaluate total debts effecting equity

2. Get the attorney involved early to assist with number 1 listed above

3. Be prepared for the day you have a signed contract so that you can quickly submit a complete short sale package

4. Control the Broker’s price opinion by meeting with the Realtor face to face and providing the Realtor with all of your information on the property.

5. Fight for your position if necessary (2nd BPO, Appraisal)

6. Never be afraid to ask for more!

Nyles L. Courchesne, Esq.

101 State Street

Suite 301

Springfield, MA 01103

Phone:413 734-1002

Fax: 734-0029

On the web: mailto:www.nlc@pcalaw.net

Email: nlc@pcalaw.net

For more information, copies of attachments referenced, but not included in this post, please call or email above.

Copyright 2008 Nyles L. Courchesne all rights reserved

Sunday, March 2, 2008

Slow Sales in January/ February

With a current inventory of ~ 110 Longmeadow homes for sale (MLS + FSBO) , these latest sales figures do not bode very well for sellers. While media pundits prophetize that sales will pick up in late 2008 or early 2009, no one really knows since buyer psychology as well as the health of the national economy will play important roles in a housing turnaround.

While it is still before the emergence of the Spring selling season, emergence of tulips from their winter sleep will likely increase the number of home for sale to at least 130-140.

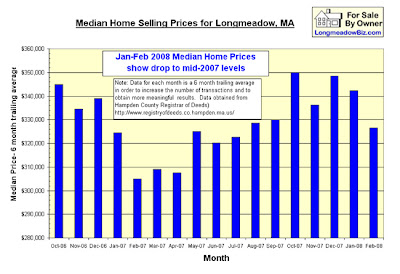

It looks like median sales prices have retreated recently as shown in the graph below:

Sunday, February 10, 2008

Local Housing Data

The most significant trends from 2005 to 2007 for Longmeadow include stable median sales prices ($330,000 -> $320,000 -> $330,000), longer time to sell (56 days -> 84 days -> 91 days) and fewer home sales (199 ->178 -> 186).

This resource is certainly worth evaluating if you want to learn more about the local real estate market.

Pioneer Valley Real Estate

- The real estate situation for many towns in the Pioneer Valley is quite different from Eastern Massachusetts and other parts of the country. One local exception may be portions of the City of Springfield which has been hit pretty hard with foreclosures- some of which may be a result of rental property speculation and others related to the problems in sub-prime mortgages.

- While the number of homes sold in the Pioneer Valley dropped in 2007 (4891) as compared to 2005 (5865) – a 16.6% drop, median home sales prices have been pretty stable over the past couple of years.

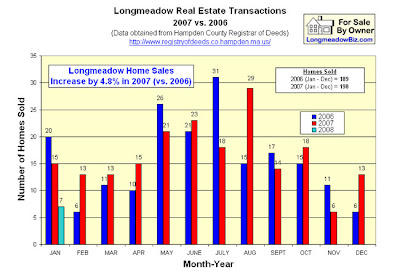

[As summarized in a previous "Buzz" blog article, the number of sales in Longmeadow actually increased in 2007 (198) vs. 2006 (189) – a 4.8% increase.] - One reason for the more stable prices in our local real estate market vs. turmoil (large price drops) in the rest of the country may be the lower level of housing speculation for the Springfield area.

- Prices are relatively soft, the inventory of unsold homes is relatively high and fixed rate mortgage rates are dropping making for a “buyers market”. For those people with good credit and an interest in purchasing a home for the long term, now may be a great time to find that dream home. It is very difficult to time the purchase of a home at the exact bottom of the real estate slump.

The article is worth taking the time to read.

Friday, February 1, 2008

Longmeadow Home Sales Slow in January

Now that the Federal Reserve has reduced interest rates by another 0.50% this past week, lower mortgage rates are likely in the near future.

With home prices likely to be flat or down slightly and homes for sale in most price ranges, the upcoming spring selling season promises to be a great time to buy a home in Longmeadow.