Wednesday, November 3, 2010

A great time to purchase or refinance a home.

Dave Rosen- Pegasus Investment Group, LLC

http://www.the-mortgage-guy.biz/

Sunday, October 10, 2010

Good news for Longmeadow Real Estate!

After a very slow start for 2010 with February, April and May being three of the worst sales months in the past five years, a significant rebound in the period from June through September have put YTD sales at about the same level as for 2008 and 2009.

However, 2010 YTD sales levels are still much lower than for the corresponding periods in 2006 (157) and 2007 (161).

Median sales prices for homes in Longmeadow increased significantly for both August and September vs. the January - July 2010 period (see figure 3). Median prices for September 2010 are now only 6% lower than the peak reached in September 2007 ($330,800 vs. $350,000).

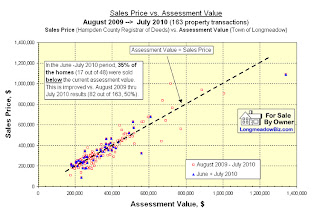

A large percentage of homes continue to be sold at prices below the official assessment value continuing a trend that has been in place for the past two years (see figure 2). For the August - September 2010 period 51% of the home (19 out of 37) were sold below the current assessed value. This data is almost identical to the results observed for the past year (52%, 86 out 165).

|

| Figure 1 (click here to enlarge) Below is a chart showing the relationship between recent Longmeadow real estate Sales Prices and Assessed Values (data obtained from Vision Appraisal website). Figure 2 (click here to enlarge) Figure 3 (click here to enlarge) Let's hope that these latest home sales data and the current low mortgage interest rates will continue to provide some stability to the Longmeadow housing market. Longmeadow FSBO East Longmeadow FSBO House for Rent at LongmeadowBiz LongmeadowBiz.com- Longmeadow's #1 Business and Community website LongmeadowMA.org- Longmeadow's Newest Website |

Monday, August 2, 2010

July 2010 Longmeadow Homes Sales

Highlights

Some great news!

- Home sales in Longmeadow for June and July 2010 have been the highest back-to-back months since 2006. A total of 48 homes were sold in the last two months with some of the volume in June attributable to the expiration of the $8K credit for new home buyers at the end of June.

- After a very slow start for 2010 with February, April and May being three of the worst sales months in the past five years, a significant rebound in June and July have put YTD sales at the same level as for 2008 and 2009. (2008- 91; 2009- 91 and 2010- 90). However, sales levels are still much lower than for the corresponding periods in 2006 (125) and 2007 (118).

- In July median sales prices for homes in Longmeadow continued to hold and show stability. For the past 7 months median sales prices have held at ~ $300,000 (see figure 3). However, median prices in July 2010 were still 14% lower than the peak reached in September 2007 ($302,500 vs. $350,000).

- A large percentage of homes continue to be sold at prices below the official assessment value continuing a trend that has been in place for the past two years (see figure 2). For the June- July 2010 period ~ 35% of the home (17 out of 48) were sold below the current assessed value- with some homes selling more than $200,000 below assessment values.

|

| Figure 1- (click chart to enlarge) Figure 2- (click chart to enlarge) Figure 3- (click chart to enlarge) |

Longmeadow FSBO

East Longmeadow FSBO

House for Rent at LongmeadowBiz

LongmeadowBiz.com- Longmeadow's #1 Business and Community website

Buying or Refinancing a Home – Why NOW really IS the time!

Being in the business as long as I have, I consistently hear people say things about their mortgage or the impact of their personal “situation” that just aren’t 100% accurate. Your mortgage is as personal and specific to you as your clothing. It’s not one size fits all, and listening to friends and family, and their experiences, can be a very dangerous thing; one that can stymie you in a time when you should be taking action.

Here are some things that you should avoid saying out loud without professional input:

“My credit isn’t very good.” First of all, define “isn’t very good”… compared to what or to whom? Credit is one of the most misunderstood aspects of the mortgage process nowadays. TRUE, the mortgage lenders today will price a loan differently for someone with a 640 FICO as compared to a 740 FICO. But that doesn’t put you out of the game, nor does it penalize you very much at all. And, there are some very simple moves you can make that will dramatically improve your score, once you understand. Besides, there’s nothing wrong with a 640 credit score. MYTH BUSTER… paying off your credit cards doesn’t help you! It can actually hurt your score.

“My house declined in value, so I can’t refinance.” Not true. There are programs (that I can show you) that may allow you to refinance even if all your equity is gone. I recently refinanced a couple who had originally put down 20% in order to avoid mortgage insurance. They had since lost 13% of their equity and the loan to value (amount owed divided by appraised value) on the home was now going to be 93%. Using a special program supported by both Fannie Mae and Freddie Mac I was able to refinance them to market rates AND they did NOT have to pay mortgage insurance.

“I’m waiting for rates to go down a little lower.” Why? Let’s do some math. If you have a $200,000 mortgage and you could get a rate, for example, of 4.75% for 30 years, your monthly principal and interest payment would be $1043.30. If the rate went to 4.625%, your principal and interest payment would be $1028.28… a whole $15 different. If the current rate would save you a whole bunch of money (let’s say $200/month), would you risk that to save another $15? Action will secure your savings. Inaction will depress you in the long run because once they start to go up, you’ll long for that low point you missed! Besides, even if rates would continue down from here… how far are they going to go? Not enough that would cause you to refinance again, that’s for sure.

“We want to lower our monthly payment, so we’re going to put down an extra $10,000.” Think twice before you use all your liquid capital to make a purchase. Yes, if you’re going to avoid monthly mortgage insurance payments, that’s a great idea. But otherwise, you may miss that money once it’s used. At a rate, for example, of 4.75% for a 30 year mortgage, every $1,000 equals $5.22 a month in payment. So, $10,000 is a savings per month of only $52.20, or $600 a year, or a break even (compared to your $10,000) of 16+ years.

“The housing market sucks.” Yes, maybe if you’re the seller. But if you’re a buyer, it’s a great time. And if you’re refinancing, it doesn’t matter what your house appraises at UNLESS it keeps you from your mission. If you have tons of equity in your home and you just want to refinance to lower your monthly payment or shorten your mortgage term, it doesn’t matter if your home appraises lower than you think it should. Sure, it may be a bit depressing, but if you’re not selling your home it doesn’t matter. Take advantage of the rates!

“It’s tough to get a mortgage.” Not really. It can indeed be a process, and, no doubt, lenders are turning over rocks more than ever. But that doesn’t mean there isn’t mortgage money available. Don’t listen to your friends and neighbors… ask a professional.

The whole real estate and mortgage world often gets bad press because, as we know, the media loves for you to think that the sky is falling; it makes good press. But ask the question before you assume the bad news applies to you.

David Rosen- "The Mortgage Guy"

Sunday, July 4, 2010

Latest Longmeadow Home Sales Data

1Q-2Q/2010 Highlights

The first five months of 2010 showed very low home sales levels with February, April and May 2010 being the three of the worst sales months in the past 5 years. Only 5 homes were sold in February. However, June showed one of the best months in the past five years with 31 homes being sold. This rebound in June home sales may have been due in large part to the $8000 home buyers credit for sales transactions closing by June 30.

With the large number of sales in June Longmeadow's January - June 2010 sales results were only slightly lower than the comparable period last year (see figure 1) but much lower (-27%) as compared to 2007- the last good year for home sales in Longmeadow.

1Q-2Q/2010: 73 1Q-2Q/2009: 74 1Q-2Q/2008: 64

1Q-2Q/2007: 100 1Q-2Q/2006: 94

During the 1Q-2Q/2010 median sales prices for homes in Longmeadow appeared to stabilize at ~ $300,000 (see figure 3). However, median prices in June 2010 were still 14% lower than the peak reached in September 2007 ($301,250 vs. $350,000).

A large percentage of homes continue to be sold at prices below the official assessment value continuing a trend that has been in place for the past two years (see figure 2). For the 1Q-2Q/2010 ~ 40% of the home (29 out of 73) were sold below the current assessed value- with some homes selling more than $100,000 below assessment values.

Let's hope that the June sales data and the current low mortgage interest rates will continue to provide some stability to the Longmeadow housing market.

Longmeadow FSBO

East Longmeadow FSBO

House for Rent at LongmeadowBiz

LongmeadowBiz.com- Longmeadow's #1 Business and Community website

Saturday, April 24, 2010

FOR SALE BY OWNER / QUICK GUIDE TO SUCCESS- PART II

A. Preparation and Marketing Costs: Every FSBO Seller should expect the following costs in preparing and marketing their property for sale:

Appraisal: As discussed in part one of this series, in determining the value of the home an appraisal is a must. Expect to pay $200 - $400 for a professional; appraisal.

On-line Services: Different web sites offer on-line marketing opportunities at little or no cost. One of the most professional services available for on-line marketing and a fantastic resource for Selling your own home in Longmeadow and East Longmeadow can be found at LongmeadowBiz.com. For $129 LongmeadowBiz will provide you with a great web marketing tool with some unique features.

Another great resource for marketing your property can be found at Craig's List Talk to Jim Moran at LongmeadowBiz- (413) 567-9428 if you want a classy appearance on Craig’s List (see example).

Listing Only Services: The Multiple Listing Service (MLS) is the place where homes are advertised to Realtors and their Buyers. There are a couple of companies that provide listing only services in Western Massachusetts. They offer flat fee MLS services ranging from less than $100 to $325. Carnevale Real Estate in Wilbraham, MA offers a special rate of $79 for 3 months. Call Tina at (413) 262-3800 and mention LongmeadowBiz to get this special rate.

Local Newspaper Ads: It is also a good idea to advertise the home and any open houses that you wish to have in the local paper during the week and on Sundays. Prices will vary.

Smoke Detector / Carbon Monoxide Detector Certificates: Every home / unit, sold for residential purposes in Massachusetts must be accompanied by a smoke detector certificate issued by the fire department from the City or Town in which the property lies. The purpose of the certificate is to ensure that the home being sold has adequate smoke and carbon monoxide detectors. A Seller should contact their local fire department to determine how many and what type of detector is needed for each living area of the home so that the home "passes" when it is inspected. The fee is typically $25- $50 per living unit, i.e. if you are selling a three family home in some Cities or Towns you may have to purchase three certificates.

Additional Costs: Additional costs of sale may occur if you have any unusual features to your property such as a septic system, asbestos, lead, underground fuel tanks or any environmental issues on the property. These items may cost thousands of dollars to bring into compliance before a sale is possible. Generally speaking it is in your best interest as a Seller to remove all of the above mentioned issues from the equation before you enter an agreement with a Buyer. You could save thousands of dollars. You should review these issues with your attorney before you list the property for sale.

B. Closing Costs: The closing costs consist of mortgage payoffs, tax stamps, attorney fees, overnight fees, discharge recording fees and discharge tracking fees.

Mortgage and Lien Payoffs: These are the payoffs for the mortgage, equity lines and any other liens that you may have on your home. When reviewing these numbers keep in mind that the interest is always running and that making a payment will not reduce your balance by the entire payment.

Tax Stamps: Tax stamps are a Seller fee that is collected at the registry of deeds at the time of recording. Tax stamps are calculated at $4.56 per $1,000 of the consideration listed on the deed. A deed for $100,000 would require tax stamps of $456.

Attorney Fees: Expect to pay a little more for attorney fees when selling your own home. I charge $200 more due to the additional time that I will spend with my clients. A typical fee for FSBO representation is $800.

Overnight Fees: Every mortgage and lien must be paid to the day (remember that interest is running) and such payments will be mailed overnight to the creditor. Overnight fees average $20 each.

Discharge Recording: Seller must pay the cost of recording discharges for all mortgages and liens that are on record. This is a one page document from the creditor that indicates a debt is satisfied and removes the lien. Each discharge or release costs $75 to record.

Discharge Tracking: In Massachusetts it is common for the Buyer's attorney to charge $75 per mortgage or lien to track the discharge or release in order to insure that the title is cleared.

Adjustments: Taxes, water and sewer, trash, condo, homeowner's association, fuel and other miscellaneous municipal charges as may apply are all adjusted to the day of the closing. A Seller who has prepaid for an item such as taxes will be reimbursed for the period of time that has been prepaid. Any service that is billed in arrears must be paid by the Seller and will be credited to the Buyer through the day of the closing. In Massachusetts adjustments are calculated so that the Buyer pays for the day of the closing. This usually means that there will be a swing of several hundred dollars for adjustments in the Seller's

Following is an example of the typical costs for a $250,000 sale:

$250,000 sale price

- 1st mortgage payoff of $100,000

- Equity line payoff of $45,000

- Tax Stamps ($4.56 per thousand x 250) = $1140

- Attorney Fee $800

- Overnight Fees ($20 each x2) = $40

- Discharge recording fee ($75 each x 2) = $150

- Discharge Tracking Fee ($75 each x 2) = $150

Net Proceeds = $102,720 +/- adjustments for taxes, water and sewer, etc

Previous posts: Massachusetts For Sale By Owner / Quick Guide to Success- Part I

Nyles Courchesne is an attorney specializing in real estate for the past 15 years. He is a partner with the law offices of Peskin, Courchesne & Allen, P.C., located at 101 State Street, Suite 301, Springfield, MA 01103 - ph. 413.734.1002 - fax 413.734.1002 email: nlc@pcalaw.net and on the web: www.pcalaw.net

Disclaimer: In accordance with rules established by the Supreme Judicial Court of Massachusetts, this web site / blog must be labeled "advertising." It is designed to provide general information for clients, prospective clients and friends of mine and my law firm and should not be construed as legal advice, or legal opinion on any specific facts or circumstances. This web site / blog is designed for general information only. The information presented at this site / blog should not be construed to be formal legal advice nor the formation of a lawyer/client relationship.

Sunday, April 18, 2010

MASSACHUSETTS FOR SALE BY OWNER / QUICK GUIDE TO SUCCESS- PART I

First two steps in selling your own home:

Before you can sell your home, it is important to determine what you will net from the sale. Obviously you must determine if the move is feasible in the first place. Your relocation options will depend on how much money you receive from the proceeds of the sale.

Step One: Determine the Value of Your Home

This is a critical step and most Realtors will tell you it is 80% of their job as a listing agent, i.e. pricing the home correctly is what they are primarily paid to do. In the absence of Realtor guidance, Sellers often look to their city or town's assessor's office to see what value the city or town is basing the property taxes. This figure can be off by tens of thousands of dollars and is not an accurate guide to the current market value. Usually, the assessed value is based upon selling prices in a prior year not the current market selling price.

There are many on-line websites such as Trulia and others that do an automated "Market Analysis". These values may also fluctuate wildly.

The bottom line is that your best bet is to have the property professionally appraised. Such appraisals cost between $200 and $400 and are worth every dime. BONUS: You can hand out the appraisal to potential buyers and use the appraisal for information for your own advertising. (Gary Oakley an appraiser from Western Massachusetts indicated that he would provide an appraisal for $200 - ph. (413) 788-7880, email geoakley@hotmail.com)

Dangers of mis-pricing your home: Saving $10,000 on a Realtor’s commission only to undervalue your property by $20,000 does not make economic sense. Getting a professional appraisal will help you avoid this mistake.

A more common mistake, however is to overprice the home. Over the past five years, the values of homes in some areas have decreased dramatically. However, many Owners today believe that their homes are worth far more than their actual current market value. This misperception leads to overpricing in the current buyer’s market.

The dangers of overpricing the home are three-fold:

1. An overpriced home will sit on the market for a long period of time. If you are relocating, this could result in an Owner carrying two properties - new house and old house - for a long time at substantial costs.

2. Even if the price is adjusted down, some buyers will only look at homes that have come on the market recently. Your pool of Buyers may be reduced to bargain hunters.

3. A property that sits for a long time may create the perception that there is some defect in the home or that the Owner is desperate to sell the home. In both cases this will attract "low-ball" offers.

Ultimately overpricing may cause an Owner to sell the home for below market value and at additional costs. GET AN APPRAISAL.

Nyles Courchesne is an attorney specializing in real estate for the past 15 years. He is a partner with the law offices of Peskin, Courchesne & Allen, P.C., located at 101 State Street, Suite 301, Springfield, MA 01103 - ph. 413.734.1002 - fax 413.734.1002 email: nlc@pcalaw.net and on the web: www.pcalaw.net

Disclaimer: In accordance with rules established by the Supreme Judicial Court of Massachusetts, this blog posting must be labeled as "advertising." It is designed to provide general information for clients, prospective clients and friends of mine and my law firm and should not be construed as legal advice, or legal opinion on any specific facts or circumstances. This blog posting is designed for general information only. The information presented in this blog posting should not be construed to be formal legal advice nor the formation of a lawyer/ client relationship.

Friday, April 2, 2010

1Q/2010 Longmeadow Home Sales are disappointing!

1Q/2010 Highlights

2010 has started out very slowly with January - March home sales down 16.6% from 1Q/2009 and down 39.0% from 1Q/2007. Longmeadow's 1Q/ 2010 sales results seem to be in contrast with other parts of the northeastern US that recently have been showing improving sales volumes. The number of homes sold in the first three months of 2010 were significantly lower than the corresponding period last year and much lower than the last good year for home sales (2007). Only 5 homes were sold in February 2010.

1Q/2009: 30

1Q/2008: 23

1Q/2007: 41

[click to enlarge chart]

During the 1Q/2010 median sales prices for homes in Longmeadow continued a downward trend after showing some recovery in mid-2009. Median prices in March 2010 were 15.7% lower than the peak reached in September 2007 ($295,500 vs. 350,000).

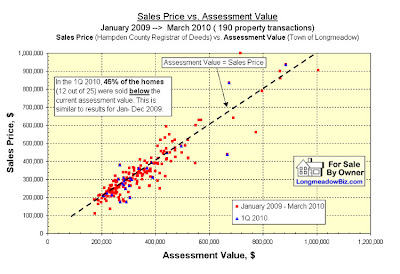

A large percentage of homes continue to be sold at prices below the official assessment values continuing a trend that has been in place for the past two years. For the 1Q/2010 ~ 45% of the home (12 out of 25) were sold below the current assessed value- with some homes selling over $100,000 below official assessment values.

A large percentage of homes continue to be sold at prices below the official assessment values continuing a trend that has been in place for the past two years. For the 1Q/2010 ~ 45% of the home (12 out of 25) were sold below the current assessed value- with some homes selling over $100,000 below official assessment values. Let's hope that the warm weather, low interest rates and improving economy will reinvigorate the Longmeadow housing market.

Let's hope that the warm weather, low interest rates and improving economy will reinvigorate the Longmeadow housing market.Longmeadow FSBO

East Longmeadow FSBO

House for Rent at LongmeadowBiz

LongmeadowBiz.com- Longmeadow's #1 Business and Community website

Wednesday, March 31, 2010

New MA Smoke Detector Laws Effective April 5th 2010

The Board of Fire Prevention Regulations has approved an emergency amendment to 527 CMR 32 Approved Smoke Detectors. This regulation applies to units undergoing sale or transfer of buildings containing up to five residential units. The regulation, which was scheduled to go into effect January 1, 2010, has been moved to April 5, 2010. At that time the regulation will still require photoelectric smoke detectors within 20 feet of a kitchen or bath containing a shower. Areas located beyond 20 feet will be required to contain dual detection by either a single unit or two separate units. In addition to the date change the regulation has been clarified to indicate it applies to residential units constructed prior to January, 1975 that have not undergone major alteration covered by the State Building Code. It also contains a provision for low voltage household warning systems that may have been installed in these homes.

For more information go to: www.mass.gov/dfs , or call the local fire department's prevention office.

Carbon Monoxide Alarms:

Since March 2006 homes have been required to install carbon monoxed detcetors on each inhabitable level as well, this remains in effect.

The smoke certificate required to transfer properties in MA includes both a smoke and a carbon monoxide test performed by the town fire department. This document is required for all closings

More Green Energy Topics - Iceland and Volcanoes vs Cloud Computing Powered by Coal.

http://www.youtube.com/watch?v=XRAQrDduaU0

At the opposite end of the spectrum is the United States use of coal power which is a huge source of air pollution and greenhouse effects. Specifically Greenpeace is claiming our increased use of Cloud computing is powered by coal plants. A distrubing thought as we amp up our use of internet data.

Coal Fuels Much of Internet 'Cloud,' Greenpeace Says:

"The 'cloud' of data that is becoming the heart of the Internet is creating an all-too-real cloud of pollution as Facebook, Apple and others build data centers powered by coal, Greenpeace said in a new report to be released on Tuesday.

Cheap and plentiful, coal is the top fuel for U.S. power plants, and its low cost versus alternative fuels makes it attractive, even in highly energy-efficient data centers."

follow link to read more:

http://bit.ly/9HN7kR

So as we increase our use of Facebook, instant movies etc we have to push these providers to rethink their energy sources. This is a very new concept to me I never thought along this line of logic but it makes sense.

Does anyone have any ideas or insights that we could or should do?

Look forward to hearing your comments.

Moira

Moira Murphy, ABR, Green

Residential Real Estate Agent

Coldwell Banker Residential Brokerage

Website: Moira.Murphy.net

Email: Moira.Murphy@NEMoves.com

Tel: Direct: 413.575.3643 / 413.567-8931 - office

Twitter: mmurfsurf

Monday, March 22, 2010

Green Living Tips for Homeowners

Some important features are: high performance windows, energy efficacies heating system, low-flow toilets and durable composite decking for porches.

When building using the following concepts can assist you to achieve a greener home: site selection and use, local and regional goals, sustainable orientation of the building on the site, storm water management.

Here are a few easy low cost ideas to implement in your home to start a “greener” life:

• Use CFL or LED light bulbs.

• Install low-flow showerheads and faucet aerators.

• Start a compost pile.

• Plant Trees.

• Insulate hot water heater.

• Weather strip and caulk doors and windows.

• Collect rainwater to water plants.

• Paint with low or no VOC paint.

• Replace filters.

• Install a programmable thermostat.

• Plant a rain garden.

• Plant native plants.

• Place appliances or office equipment on power strips to reduce “phantom” load.

• Install motioned sensors in common areas to turn off lights when no in use.

• Install water efficient restroom fixtures.

• Take advantage of day lighting.

• Provide recycling bins.

There has been a lot of talk lately about reducing our ecological footprint sometimes called "carbon footprint". This is a site that measures that footprint: Walkability Score: http://www.walkscore.com/. The following is a list of more great websites to look up “green” living ideas:

• http://www.epa.gov/earthday

• http://www.greenseal.org/

• http://www.epa.gov/

• http://www.energystar.gov/

• http://www.thegreenguide.com/

• http://www.storyofstuff.com/

To actually see and feel some of the latest in green living attend the home show this weekend at the Big E there are plenty of opportunities to “green up” your home. There is a big push towards sustainability. This is a great opportunity to actually see all the new innovative products that are being talked about. There will be building industry experts to explain about these products and possible tax credits. There will also be some interactive booths with touch screens to show how the products are made.

The Home Show March 25th – March 28th. For more information and coupons go to http://www.westernmasshomeshow.com/.

To read about a local example of green building in our area follow this link:

http://bit.ly/boad5K

A Sturbridge house built with geothermal heating, passive solar use, energy efficient spray insulation, radiant floor heating, high energy efficient windows, recycled decking, Energy Star appliances, energy efficient gas fireplaces and more.

If you are looking for something interesting to do this weekend and have been thinking of “greening up” your home, renovating, upgrading your appliances, improving your heating or cooling system this is the place to go.

If you have any ideas or would like to add anything I welcome your comments.

Moira Murphy, ABR, Green

Residential Real Estate Agent

Coldwell Banker Residential Brokerage

Website: Moira.Murphy.net

Email: Moira.Murphy@NEMoves.com

Tel: Direct: 413.575.3643

Friday, January 1, 2010

Longmeadow 2009 Home Sales

- The full year 2009 results show that the number of houses sold in Longmeadow was 3.8% higher than corresponding 2008 results (165 vs. 159) but home sales were still significantly lower than recorded for prior years (2006- 189, 13% lower and 2007- 198, 17% lower).

- During the second half of 2009 median sales prices for homes continued to show improvement from the lows observed in early 2009. Median prices at year end were 15.2% higher than December 2008.

- The number of houses sold in the last two months of 2009 was significantly higher than each of the previous three years: 2009: 29 2008: 19 2007: 19 2006: 17

- A large percentage of homes continue to be sold at prices below the official assessment values continuing a trend that has been in place for the past two years.

- For all of 2009 ~ 55% of the home (90 out of 165) were sold below the current assessed values.

- Full year 2009 results showed that higher priced homes (>$400K) may be more difficult to sell in the current environment with only 39 out of 165 homes (24%) sold priced above $400,000. (Currently there are 24 homes out of 60 listings (40%) on MLS that are priced above $400K.)

[click to enlarge chart]

Below is a chart showing the relationship between recent Longmeadow real estate Sales Prices and Assessed Values (data obtained from Vision Appraisal website).

During November- December 2009 time frame ~45% of the homes sold (13 out of 29) were at prices less than the official assessment value. For all of 2009 55% of the homes (90 out of 165) were sold below the official assessment value.

Note: The latest November/ December home sales results are compared to the new FY2010 assessed values.

During the second half of 2009 median sales prices for homes continued to show improvement from the lows observed in early 2009. Median prices at year end were 15.2% higher than December 2008.

Despite these mixed results it does appear that a bottom may be forming for the Longmeadow real estate market (as well as the rest of the US). This combined with a recovery economy may lead to a more normally functioning real estate market in 2010.

Despite these mixed results it does appear that a bottom may be forming for the Longmeadow real estate market (as well as the rest of the US). This combined with a recovery economy may lead to a more normally functioning real estate market in 2010.

Here is a link to the data for 2006-2009 Real Estate Transactions that were used to develop the above graphs.

Longmeadow FSBO

East Longmeadow FSBO

House for Rent at LongmeadowBiz

Vacation Rentals at LongmeadowBiz

LongmeadowBiz.com- Longmeadow's #1 Business and Community website